Estate Taxes, Trusts, and Complex Assets: What You Risk Without Professional Guidance

Estate planning is not just a process reserved for the wealthy. Whether you own a modest home, multiple bank accounts, or valuable business interests, planning for the future is one of the most important steps you can take to protect your family and loved ones. Many people fail to realize how estate taxes, trusts, and complex assets can create confusion, trigger probate court disputes, and lead to unintended consequences if they don’t secure experienced legal guidance.

Below, we’ll explore why working with a knowledgeable will and trust lawyer is essential to protect your assets, fulfill your wishes, and maintain peace of mind.

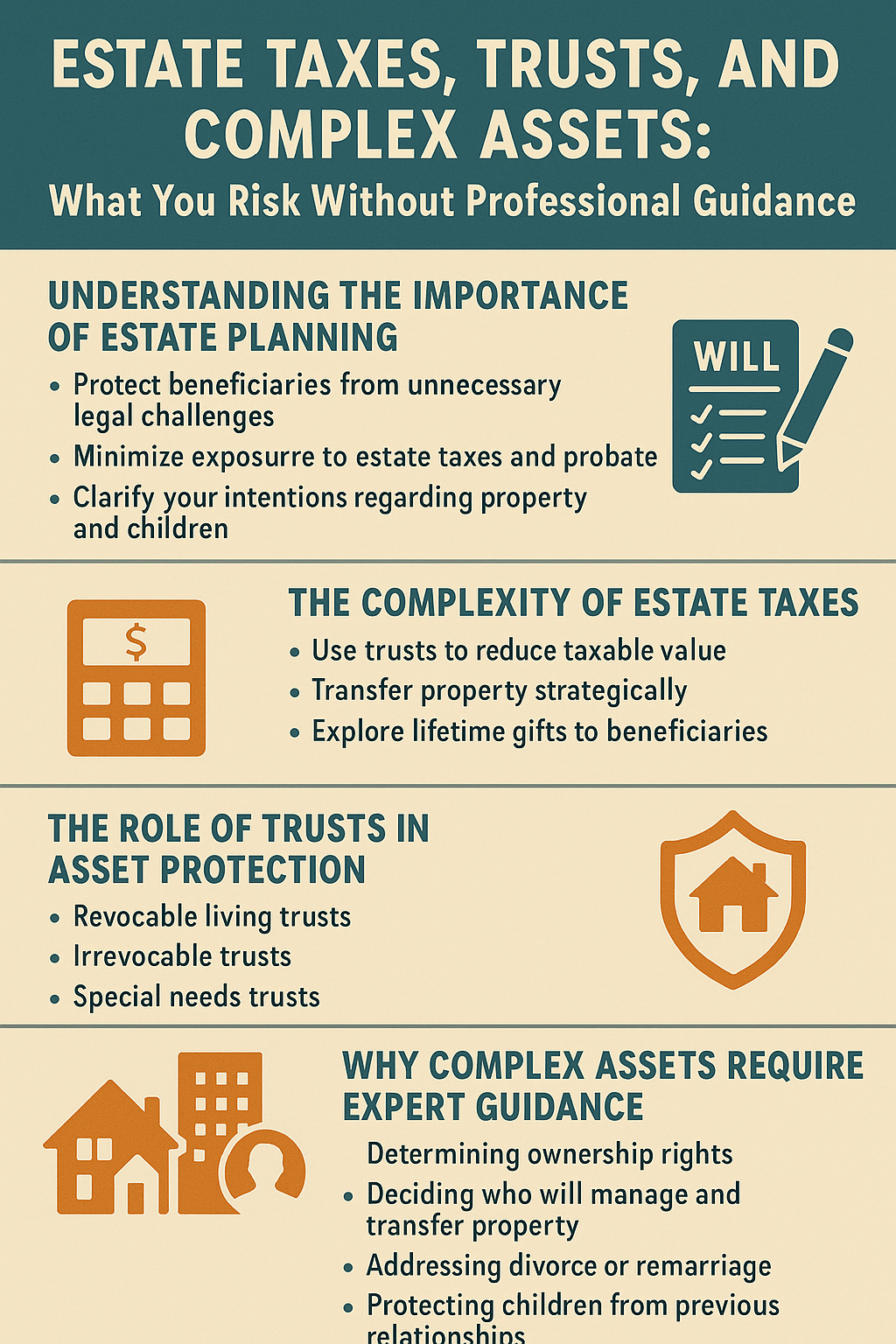

Understanding the Importance of Estate Planning

Estate planning means more than simply drafting a last will. It involves creating a comprehensive plan for your property, financial decisions, and end of life planning. Proper estate planning documents can:

- Protect your beneficiaries from unnecessary legal challenges

- Minimize exposure to estate taxes and probate

- Clarify your intentions regarding your property and children

- Provide clear instructions for trust administration

The estate planning process should be guided by experienced estate planning attorneys who can help you prepare documents that stand up in court and reflect your goals.

The Complexity of Estate Taxes

Many families underestimate how quickly estate taxes can erode wealth. Depending on the size of your estate, taxes may apply to:

- Real estate

- Investment portfolios

- Business interests

- Life insurance proceeds

Without proper planning, your loved ones may face a significant tax burden after your death. A qualified attorney can help you:

- Use trusts to reduce taxable value

- Transfer property strategically

- Explore lifetime gifts to beneficiaries

- Prepare legal documents to support your plans

These steps require careful consideration, detailed knowledge of tax law, and professional experience.

The Role of Trusts in Asset Protection

Trusts are powerful tools for managing complex assets. They can shield property from public record and probate, protect beneficiaries, and offer privacy for your family. Common types of trusts include:

- Revocable living trusts

- Irrevocable trusts

- Special needs trusts

- Charitable trusts

Each trust has unique benefits and requirements. An experienced estate planner can help you decide which options align with your goals and draft documents that are legally enforceable.

Why Complex Assets Require Expert Guidance

Assets like closely held businesses, real estate in multiple states, and blended families complicate the estate planning process. These situations create challenges, such as:

- Determining ownership rights

- Deciding who will manage and transfer property

- Addressing divorce or remarriage

- Protecting children from previous relationships

Without the assistance of an experienced attorney, families often struggle to resolve these issues, leading to costly litigation and family discord.

Probate: The Public Process You Might Be Overlooking

Many people do not realize that wills alone do not avoid probate court. Probate is a public, court-supervised process that can:

- Delay asset distribution

- Increase expenses

- Expose your private affairs to public record

By working with estate planning attorneys, you can structure trusts and other estate planning documents to keep your estate out of probate whenever possible. This not only saves money but also ensures your wishes remain private.

The Risks of Do-It-Yourself Estate Planning

Online forms and DIY estate planning kits often look appealing because they promise quick and affordable solutions. However, these tools can:

- Fail to comply with state-specific laws

- Omit important provisions for minor children

- Overlook tax consequences

- Leave out critical legal documents

The result is incomplete or invalid plans that create confusion and conflict. Engaging experienced estate planning attorneys provides confidence that your plan is thorough and enforceable.

Protecting Your Loved Ones From Unintended Consequences

Without clear planning, your family may encounter challenges like:

- Disagreements over property distribution

- Delays accessing bank accounts

- Conflict among beneficiaries

- Confusion about trust administration responsibilities

A knowledgeable estate planning lawyer will anticipate potential problems and help you prepare to protect your family’s interests.

Estate Planning for Married Couples and Blended Families

Married couples and blended families face unique considerations. Questions often arise, including:

- How do you protect children from prior marriages?

- What happens if one spouse dies and the survivor remarries?

- How can you ensure long term care for a surviving spouse?

Proper estate planning can address these concerns with carefully crafted trusts, wills, and other estate planning documents.

Special Needs Planning for Vulnerable Beneficiaries

If you have a child or loved one with special needs, planning requires particular attention. Special needs trusts can:

- Preserve eligibility for government benefits

- Provide funds for quality of life enhancements

- Ensure assets are managed responsibly

This area of law is highly technical, and you should never attempt it without professional guidance.

The Benefits of Professional Estate Planning Services

Choosing experienced estate planning attorneys delivers many advantages, such as:

- Detailed knowledge of tax laws and probate procedures

- Guidance on trust administration and funding

- Drafting legally compliant documents

- Helping you manage complex assets

- Creating strategies tailored to your specific goals

Professional estate planning services provide peace of mind that your wishes will be respected.

Common Estate Planning Mistakes to Avoid

Without the help of a qualified attorney, people often make errors that cause long-term problems, including:

- Forgetting to update documents after major life events

- Failing to properly transfer property into a trust

- Overlooking retirement accounts and beneficiary designations

- Underestimating estate taxes and other costs

An estate planner can help you avoid these pitfalls.

Updating Your Plan As Life Changes

Estate planning is not a one-time event. Life changes—such as divorce, remarriage, the birth of children, or the acquisition of new property—require updates to your plan. A trusted estate planning lawyer will assist you in reviewing and revising documents to reflect your current wishes.

The Estate Planning Process: What to Expect

When you work with Masterly Legal Solutions, your estate planning process typically involves:

- An initial consultation to discuss your goals and financial situation

- A review of your current legal documents and assets

- Recommendations tailored to your family’s unique needs

- Drafting and signing of wills, trusts, and other legal documents

- Ongoing support to keep your plan current

This process ensures you have a complete, legally enforceable plan in place.

The Importance of Acting Now

Estate planning is an important step that too many people delay. Procrastination can leave your family unprotected and force them to navigate a confusing and expensive court process during a difficult time. With proper preparation, you can save your loved ones stress, money, and uncertainty.

Working With an Experienced Will and Trust Lawyer

At Masterly Legal Solutions, our experienced estate planning attorneys are dedicated to helping clients plan confidently. We understand the emotional and financial considerations involved in preparing for the future. Our team will walk you through every detail so you feel informed and empowered to make the best decisions for your family.

How Estate Planning Attorneys and an Estate Planner Help Secure Your Last Will and Long Term Care

An experienced estate planner can make all the difference when preparing your last will and outlining provisions for long term care. Skilled estate planning attorneys know how to address the complexities of your assets while ensuring your documents comply with state laws and reflect your true intentions. Whether you need to designate a guardian for minor children, create trusts, or plan for future healthcare decisions, working with a qualified professional helps you avoid costly mistakes. With thoughtful preparation, you can protect your family, preserve your legacy, and feel confident that every detail has been carefully considered.

Tips for Addressing Your Legal Needs on Behalf of Your Family

When you’re navigating estate taxes, trusts, and complex assets, it’s essential to have clear strategies that meet your legal needs and protect your loved ones. Every practice area within estate planning comes with unique rules and requirements, making it risky to rely on generic forms or assumptions. One of the most effective tips is to work with an experienced attorney who can act on your behalf to prepare customized documents and guide you through the entire process. With professional support, you can feel confident that your wishes will be honored and your family will have a solid plan in place for the future.

Take the Next Step Toward Peace of Mind

Estate taxes, trusts, and complex assets demand careful planning and expert guidance. If you have questions about protecting your estate, planning for long term care, or avoiding probate, we’re here to assist you every step of the way.

Contact us today at (972) 236-5051 to schedule your complimentary consultation with a will and trust lawyer. Our experienced team is ready to answer your questions and provide mobile services for estate planning, living trusts, and wills, wherever you need us. Your peace of mind is too important to leave to chance.

Notice: This post is not legal advice; it is merely informational in nature. Please speak with an experienced estate planning lawyer for advice tailored to your circumstances.

Looking for Legal & Business Solutions? Contact Us Now

Fill in the form or call us to set up a meeting