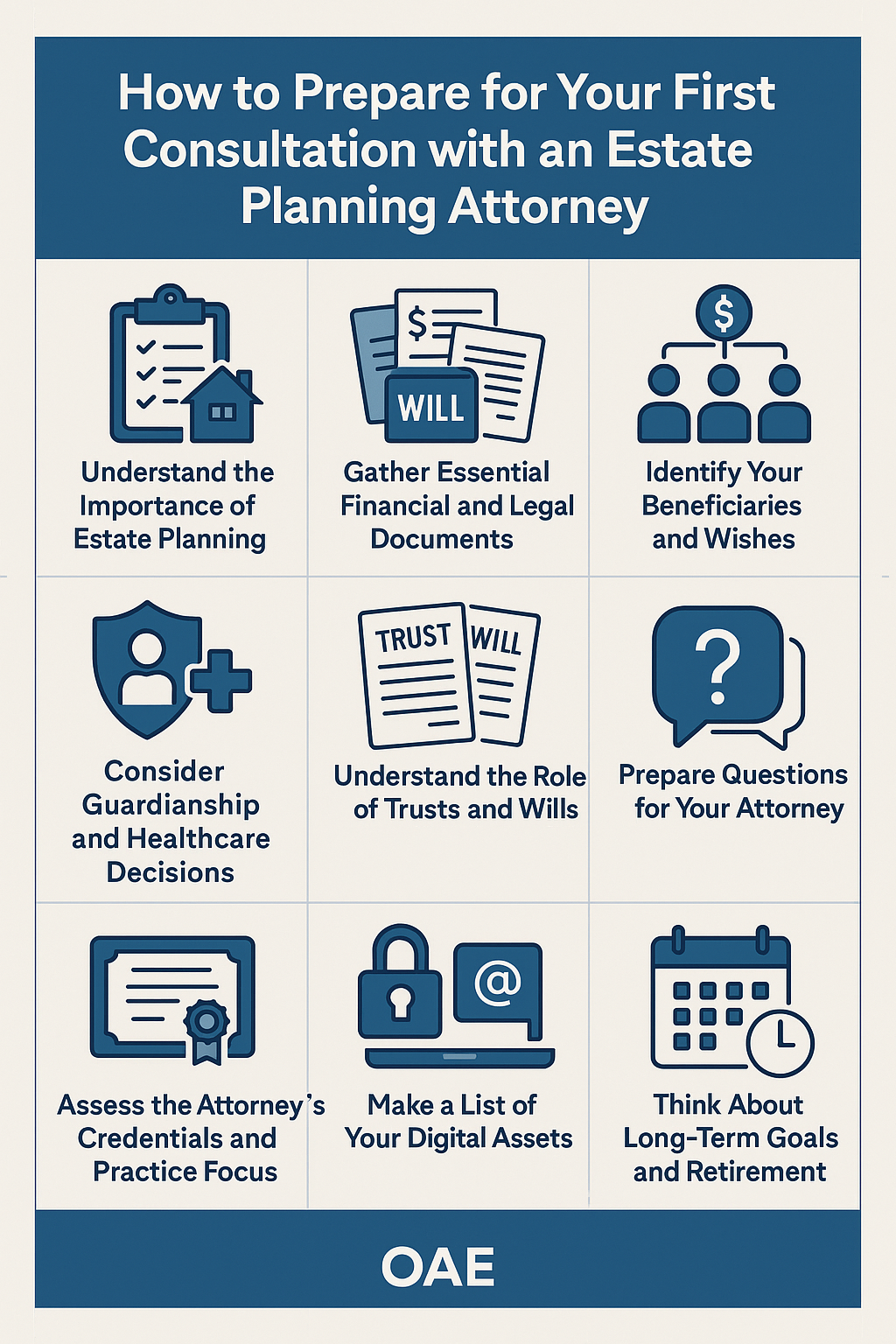

How to Prepare for Your First Consultation with an Estate Planning Attorney

Understanding the Importance of Estate Planning

Estate planning is more than just writing a will. It’s a comprehensive process that ensures your assets are protected, your wishes are respected, and your loved ones are provided for in the event of your death. An estate planning attorney plays a vital role in helping you manage this complex legal task. By working with a professional who specializes in this area, you can navigate important decisions with confidence and clarity.

What to Expect from the Estate Planning Process

Before your first consultation, it helps to understand what the estate planning process involves. Generally, this process includes:

- Evaluating your current assets and liabilities

- Deciding how your assets will be distributed upon your death

- Establishing guardianship plans for any minor children

- Determining healthcare directives and powers of attorney

- Reviewing tax implications with qualified tax professionals

The estate planning process is both personal and legal. Having a clear picture of your life, assets, and goals will allow your estate planning attorney to develop a plan tailored to your circumstances.

Gather Essential Financial and Legal Documents

Before meeting your estate attorney, prepare a packet of relevant documents. Having these on hand will help the attorney understand your financial landscape and provide accurate advice. These may include:

- Deeds and titles to any real estate or vehicles

- Recent bank and investment statements

- Existing wills or trusts, if any

- Business ownership documents

- Retirement account details

- Insurance policies

These materials allow your estate planner to assess your estate comprehensively and suggest effective strategies.

Identify Your Beneficiaries and Wishes

One of the first things your estate planning attorney will ask about is your intended beneficiaries. Prepare a list of people and organizations you want to include in your estate plan. Clearly articulating your wishes can help reduce confusion later.

Think about how you want your estate divided. Consider specific gifts for friends or family, charitable donations, and provisions for children or loved ones with special needs. This ensures your estate reflects your intentions.

Consider Guardianship and Healthcare Decisions

If you have minor children, appointing a guardian is essential. Your estate attorney will guide you through the legal steps of naming someone you trust to care for them.

You should also consider your preferences for medical care if you become unable to make decisions for yourself. Establishing powers of attorney and healthcare directives will give someone access to manage your care and financial matters during times of incapacity.

Understand the Role of Trusts and Wills

Wills and trusts serve different purposes in estate planning. A will provides instructions for asset distribution after death, while a trust can help manage assets during your lifetime and avoid probate.

Trust and estate counsel can explain the benefits of each and help determine which best suits your needs. Establishing a trust, such as a pet trust, can also help minimize taxes and protect your estate from lengthy court proceedings.

Prepare Questions for Your Attorney

Your first consultation is an opportunity to get clarity and peace of mind. Prepare a list of questions that address your specific concerns. Common topics include:

- What’s the difference between a revocable and irrevocable trust?

- How can I protect my business in the event of my death?

- What are the most effective ways to minimize estate taxes?

- Who should I name as my executor or trustee?

- How often should I update my estate plan?

These questions help your attorney understand your goals and give you a better sense of their approach and expertise.

Assess the Attorney’s Credentials and Practice Focus

Not all lawyers specialize in estate planning. Look for an estate attorney with experience in handling both simple and complex estates. Membership in the American College of Trust and Estate Counsel is a strong indicator of their commitment to excellence in this practice area.

Ask how long they’ve been practicing estate law and what kinds of clients they generally work with. Their responses will give you confidence in their ability to handle your matter with care.

Make a List of Your Digital Assets

In today’s world, digital assets are just as important as physical ones. Make a list of your online accounts, email addresses, and social media profiles. Include login information and instructions for managing these in your absence.

Discuss with your estate counsel how these assets should be handled, and how you can ensure secure access for the people you trust.

Think About Long-Term Goals and Retirement

A complete estate plan includes your goals for retirement and aging. Consider how your estate plan will align with your financial advisor’s strategy. Your estate attorney can coordinate with your financial and tax professionals to create a cohesive plan that protects your assets as you transition through life.

Having a solid retirement strategy in place can make your estate administration easier and help reduce stress on your loved ones.

Discuss the Need for Regular Updates

Your life and circumstances will change. Marriages, divorces, births, deaths, and business changes all affect your estate. Establish a relationship with an estate planner who will review and revise your plan as needed.

Many attorneys offer regular reviews to ensure your plan continues to reflect your wishes and remains legally sound. Keeping your estate documents up to date is just as important as creating them.

Review the Potential Tax Impact

Taxes can significantly affect the value of your estate. During your consultation, discuss ways to minimize taxes with your estate planning attorney. Your lawyer may collaborate with other tax professionals to structure your plan in a tax-efficient manner.

Estate tax laws vary by state, and your estate attorney can explain how those laws affect your specific situation.

Address Business Ownership and Succession Planning

If you own a business, your estate plan should include a succession strategy. Consider what will happen to your business if you become incapacitated or pass away.

An experienced planning attorney will help establish a plan that transfers ownership smoothly and protects your business’s value for your beneficiaries.

Involve the Right Professionals

Your estate planning attorney may not be the only expert you need. Estate planning is most effective when handled by a network of professionals, including:

- Financial advisors

- Tax professionals

- Insurance agents

- Business consultants

Coordinating these efforts will result in a more complete and effective estate strategy.

Identify Individuals for Key Roles

Your estate plan requires people to serve in roles of responsibility. Think about individuals you trust to:

- Manage your estate (executor)

- Oversee a trust (trustee)

- Make financial decisions on your behalf (power of attorney)

- Handle healthcare choices (healthcare proxy)

Choosing people who understand your values and wishes ensures your estate is handled according to your plan.

Be Honest and Transparent

Your first meeting is not the time to hold back. Share all relevant financial and personal details. Full transparency allows your estate attorney to provide accurate guidance.

Keeping information from your lawyer can result in a plan that doesn’t meet your goals or puts your estate at risk. Remember, your attorney is there to assist you and protect your best interests.

Discuss Your Estate’s Unique Challenges

Every estate has its complexities. Blended families, special-needs children, out-of-state property, and digital assets all introduce unique challenges. Make sure to discuss any details that could affect how your plan is structured.

Experienced lawyers know how to address these challenges with creative legal solutions tailored to your needs.

Ask About Fees and Services

Don’t be afraid to ask about fees. Understanding how your estate attorney charges—whether hourly, flat rate, or per document—can help you prepare financially. Request an overview of what’s included in their services and how future updates are billed.

Transparency about costs is essential to building a trusted relationship with your estate planner.

Avoid Common Estate Planning Mistakes

Many clients come to estate attorneys with outdated or incomplete plans. Avoid these common missteps:

- Failing to update beneficiaries after major life events

- Naming the wrong person as executor or trustee

- Not coordinating your estate plan with retirement accounts

- Ignoring the tax implications of asset transfers

- Using internet templates instead of legal professionals

Your estate counsel will help you avoid these errors and create a plan that works.

Understand the Benefits of a Living Trust

A living trust can offer flexibility and control over your assets during your lifetime and after your death. This legal tool may help your loved ones avoid probate and maintain privacy.

Discuss with your estate planning attorney whether a living trust is right for your goals. They can walk you through the process of establishing one and how it interacts with your other estate documents.

Create a Legacy That Reflects Your Values

Your estate plan is your opportunity to leave more than money—you can also leave a legacy. Consider how your values, beliefs, and charitable intentions can be reflected in your estate.

Discuss options such as donor-advised funds, family foundations, or memorial scholarships with your attorney. Planning in this way ensures your estate impacts more than just your beneficiaries.

Learn How to Handle Out-of-State Property

If you own property in another state like California, your estate may be subject to additional legal and tax requirements. Let your estate attorney know about these assets.

Establishing a trust or using transfer-on-death deeds are potential solutions your estate planner can help you evaluate.

Communicate Your Plan to Trusted Individuals

Once your estate plan is finalized, communicate it to those involved. Executors, trustees, and family members should know their roles and have access to necessary documents.

This open communication reduces confusion, builds trust, and helps your loved ones carry out your wishes effectively.

Use a Secure Method for Document Storage

Keeping your estate documents safe and accessible is vital. Discuss options with your attorney about where to store originals and how to provide access.

Many estate lawyers offer secure digital vaults or document portals. Avoid relying solely on your browser history or cloud files that others can’t access without login details.

The Value of Experience and Compassion

Estate planning is personal. Choose a planning attorney who combines legal knowledge with empathy and understanding. At Masterly Legal Solutions, we understand that every client brings unique circumstances, emotions, and family dynamics to the table.

Our team is committed to guiding you through every detail with care, professionalism, and discretion.

Don’t Delay—Your Family’s Future Depends on It

One of the biggest mistakes people make is putting off estate planning until it’s too late. The best time to start is now. Your first consultation lays the foundation for a safer and more secure future.

Planning early allows for thoughtful decisions and relieves your loved ones of unnecessary stress during an already difficult time.

Helpful Tips to Maximize the Value of Your Estate Planning Consultation

Preparing for your first meeting with an estate planning attorney doesn’t have to be overwhelming. A few helpful tips can make the process smoother and ensure that you make the most of your time. For example, visiting the attorney’s website in advance may provide insight into their practice areas, client services, and what to bring to your appointment. Many firms list downloadable forms or FAQs that offer guidance on what documents to prepare or questions to consider. Reviewing these resources ahead of time is a simple but powerful way to arrive informed and confident for your consultation.

Schedule a Free Consultation with Masterly Legal Solutions

Preparing for your first estate planning consultation is one of the most important steps you can take to protect your loved ones and manage your assets with clarity. At Masterly Legal Solutions, our experienced attorneys are ready to assist you through every step of the estate planning process. Whether you’re just starting out or revisiting an outdated plan, we provide the guidance, expertise, and personal attention you need to feel secure about your future.

Reach out today to schedule a free consultation. Let us answer your questions and build a strategy that reflects your unique goals and circumstances.

Contact us at (972) 236-5051 for a free consultation.

This article is for informational purposes only and does not constitute legal advice. For advice about your specific situation, please contact a qualified estate planning attorney.

Looking for Legal & Business Solutions? Contact Us Now

Fill in the form or call us to set up a meeting